Welco – Your AI Financial Answering Service

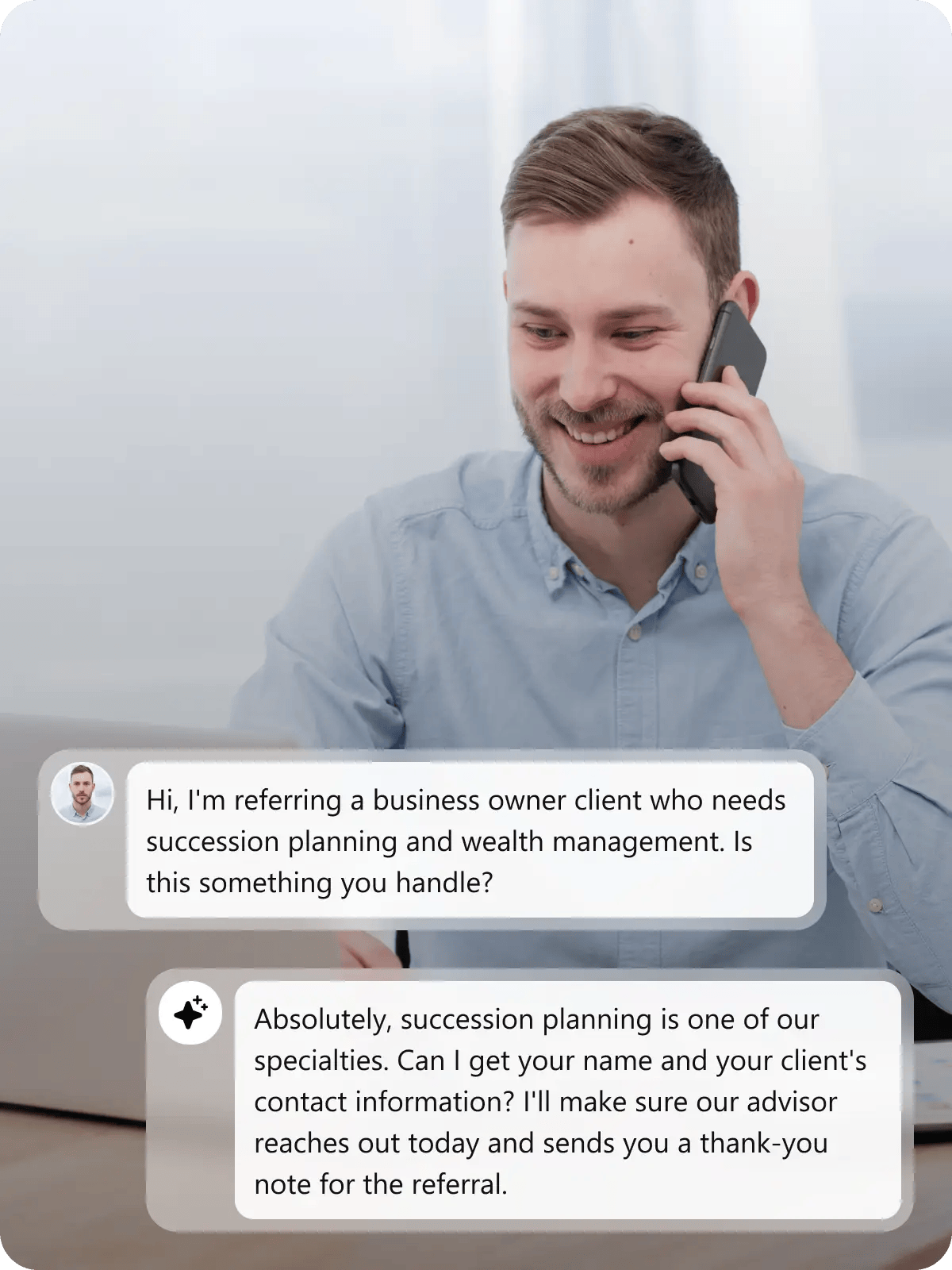

Answer Prospect Questions Without Callbacks

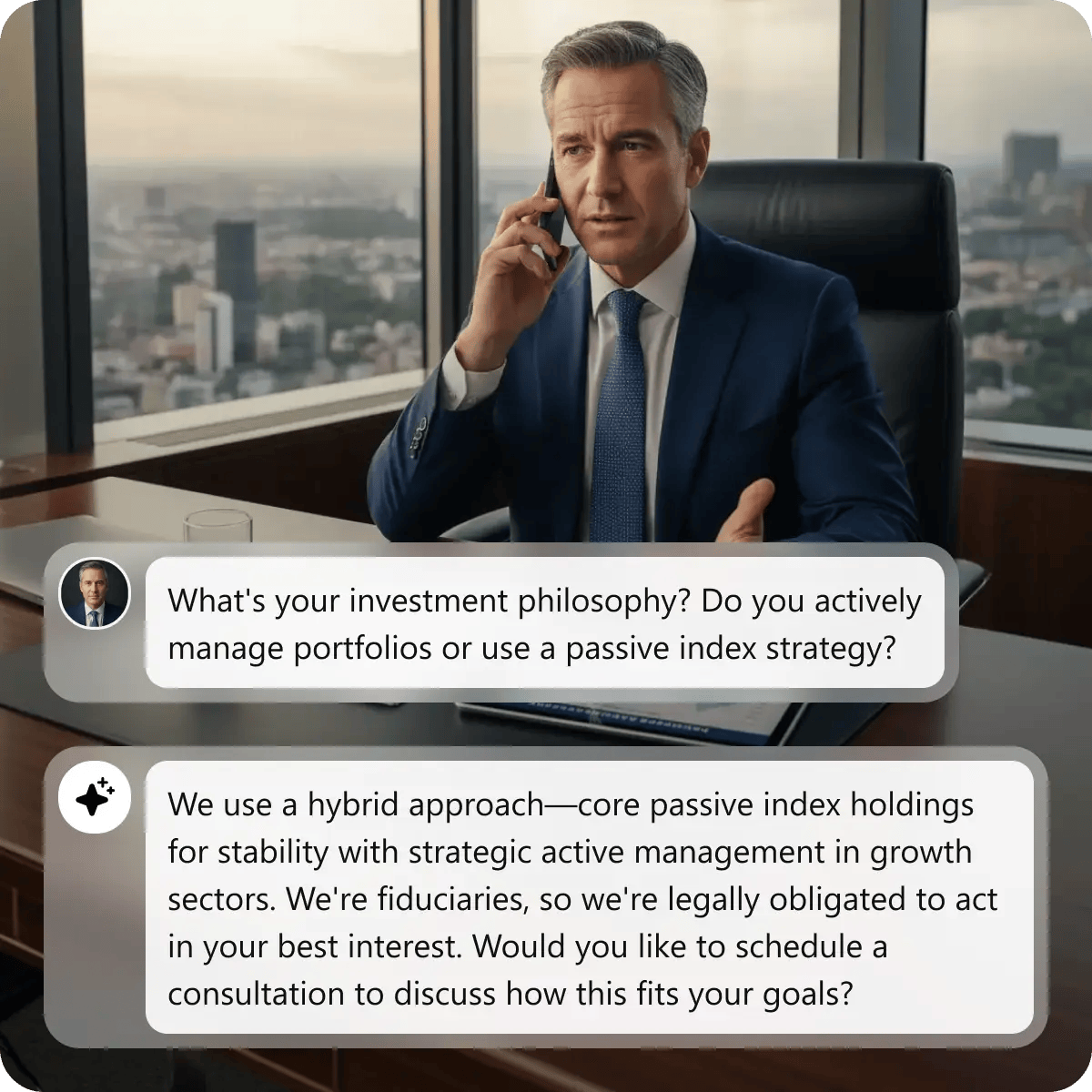

Provide immediate answers when prospects call comparing financial advisors. Your AI answering service pulls from your knowledge base to explain investment philosophy, fee structures, fiduciary status, and credentials—no more “let me have someone call you back” delays. Prospects calling about tax-loss harvesting, portfolio management, or planning processes get substantive answers instantly and book consultations while still on the call with your 24/7 answering service

Never Miss After-Hours Rollover Opportunities

Handle Multiple Calls During Market Volatility

Qualify High-Value Prospects Automatically

Get Your AI Financial Answering Service Started in 15 Minutes

Quick Setup for Your Financial Practice

We help you create your Welco account and assign a dedicated phone number using Twilio. Choose your AI voice and connect it to your financial advisory practice—no technical setup needed. Start with a free trial to see how Welco captures and manages calls in real time. Your practice starts answering every call instantly

Upload Financial Services Information

Upload service types—financial planning, investment management, retirement planning, 401(k) rollovers, estate planning—with fee structures and client minimums. Set service matching keywords like “fiduciary advisor” or “retirement consultation.” Welco learns your practice expertise and routes inquiries from a simple no-code dashboard.

Start Capturing Consultation Requests

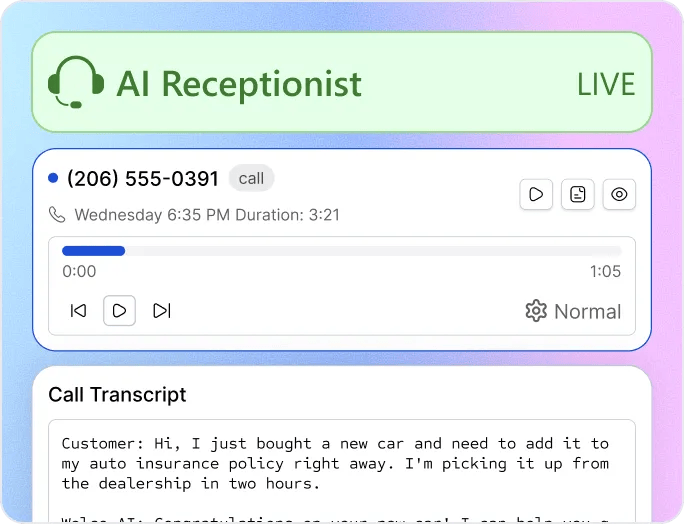

Once live, Welco answers calls instantly. Monitor transcripts, listen to recordings, and adjust FAQs anytime. Track which services prospects request most, identify popular consultation topics, and optimize booking conversions—while your team focuses on client advising. Your practice never misses another prospect opportunity.

Listen to Our AI Financial Answering Service in Action

David Callman

Turn Every After-Hours Call Into a Booked Consultation

Financial advisory firms use Welco to capture prospects researching advisors at night, qualify leads by asset size automatically, and book meetings into available calendar slots—never miss another high-value opportunity simply because your office was closed or your team was busy.

How Welco AI Financial Answering Service Solves Challenges

Current Challenges of Financial Advisors

Prospect calls three financial advisors comparing services—your receptionist says “Let me have someone call you back” while competitors answer questions immediately and book consultations on the spot, capturing the lead instantly.

Receptionist takes message from rollover prospect but doesn’t capture critical details—financial planner calls back not knowing it’s time-sensitive job change requiring immediate attention and decision-making support for urgent financial transition.

Client mentions “my CPA said I should talk to you about this”—receptionist doesn’t note referral source, you can’t thank the referring professional or track which relationships drive business growth and generate qualified leads.

Receptionist transfers prospect mid-call—financial advisor picks up with no context about what was already discussed, forcing prospect to repeat information and creating unprofessional experience that damages first impression and credibility.

Friday 4:30 PM client calls worried about market volatility they saw on financial news—office closes, call goes to voicemail over weekend while anxiety builds and competitor provides reassurance immediately, building trust.

Receptionist verbally schedules consultation but doesn’t send confirmation—prospect forgets about meeting and doesn’t show up, wasting calendar slot that could have been filled with another qualified lead ready to convert.

How Welco Fixes It

Answers questions about your services, credentials, CFP/CFA designations, planning process, and fee structures instantly from knowledge base—prospect books consultation without waiting for callback, capturing interest at the peak moment.

Intake form systematically collects current employer, 401(k) rollover amount, timeline, other advisors they’re considering, urgency level—advisor prioritizes $800K opportunities appropriately and prepares personalized consultation approach based on complete situation details.

Automatically captures and logs referral source during intake: “How did you hear about us?” documented in CRM for relationship management and marketing ROI tracking with CPAs and centers of influence for future business development.

Warm transfer includes whispered summary: “John Smith, age 58, retiring next year, has 401(k) rollover questions, assets around $750K” before connecting to advisor, ensuring seamless handoff with full context for professional, informed conversation.

Financial answering service answers call 24/7, provides context from your approved talking points about market events, schedules Monday morning callback or transfers to on-call advisor if truly urgent situation requires immediate attention and reassurance.

Automatically sends email and SMS confirmation immediately after booking with calendar invite, meeting details, required documents list, office directions, and pre-meeting questionnaire ensuring prospects arrive prepared and committed to appointment without confusion.

Stop Losing Rollovers and Referrals While Your Team Is in Client Meetings

Welco answers prospect and client calls 24/7, books consultations, and captures qualified details—so no high-value opportunity is missed while your advisors are in meetings.

FAQs About AI Financial Answering Service

What if a prospect asks detailed questions about our investment strategy or returns?

Welco only responds using the information you explicitly upload to its knowledge base. This typically includes your high-level investment philosophy, planning approach, services offered, and credentials. Welco does not provide investment advice, discuss performance numbers, or make return projections. If a prospect asks about returns or specific results, Welco follows your configured rules—usually offering to schedule a consultation or transfer the call to an advisor. You control exactly which topics Welco can answer and which are escalated to your team.