Welco – Your AI Insurance Agencies Answering Service

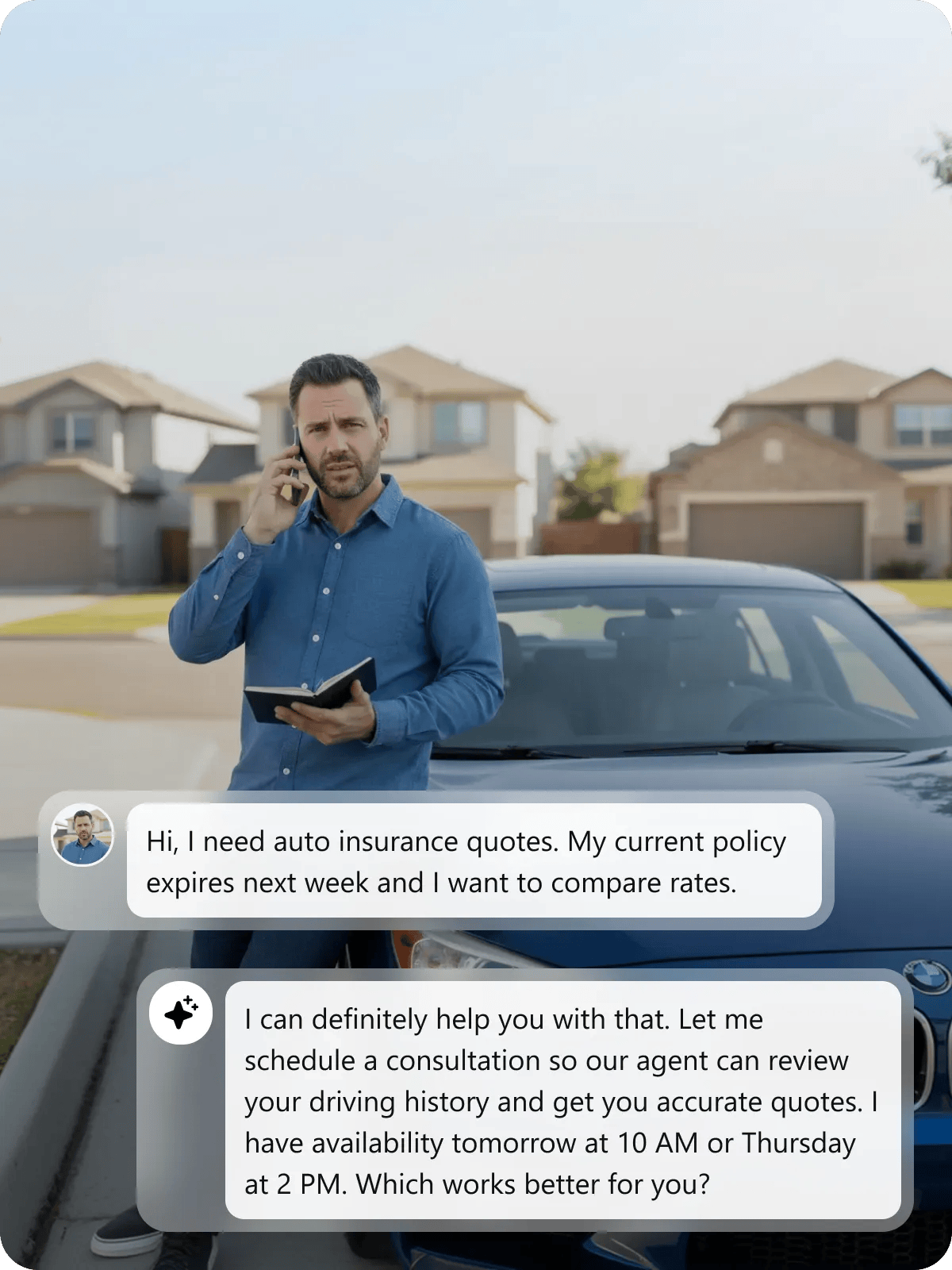

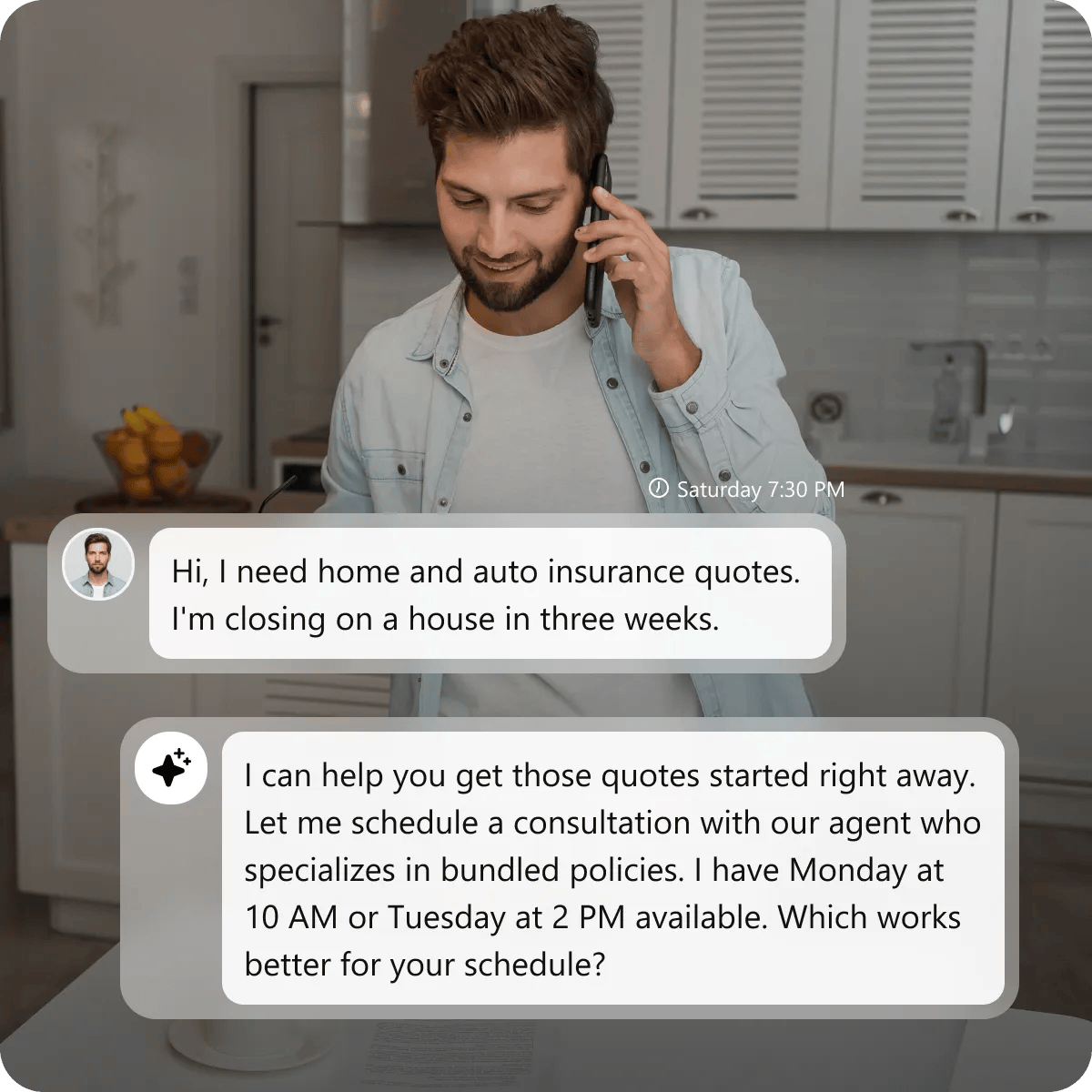

Capture After-Hours Quote Requests Before Competitors

Insurance shoppers research policies after work—evenings and weekends when your office is closed. Welco’s after-hours answering service captures every quote request immediately, collects policy details, qualifies coverage needs, and books consultations automatically. While competitors send late-night callers to voicemail, your agency schedules appointments instantly. By Monday morning, your calendar is full with pre-qualified prospects while competitors are still returning weekend messages to disconnected numbers.

Route Claims and Urgent Calls to the Right Agent Immediately

Collect Complete Policy Information Through Custom Intake Forms

Handle Peak Period Call Surges Without Hiring Staff

Get Your AI Insurance Agencies Answering Service Live in 15 Minutes

Quick Setup

We help you create your Welco account and assign a dedicated phone number using Twilio. Choose your AI voice and connect it to your insurance agency—no technical setup needed. Start with a free trial to see how Welco captures and manages calls in real time.

Upload Agency Information

Upload policy types—auto, home, life, commercial, umbrella coverage—with coverage details and pricing guidelines. Set service matching keywords like “accident claim” or “policy renewal.” Welco learns your agency operations and routes inquiries from a simple no-code dashboard.

Start Capturing Leads

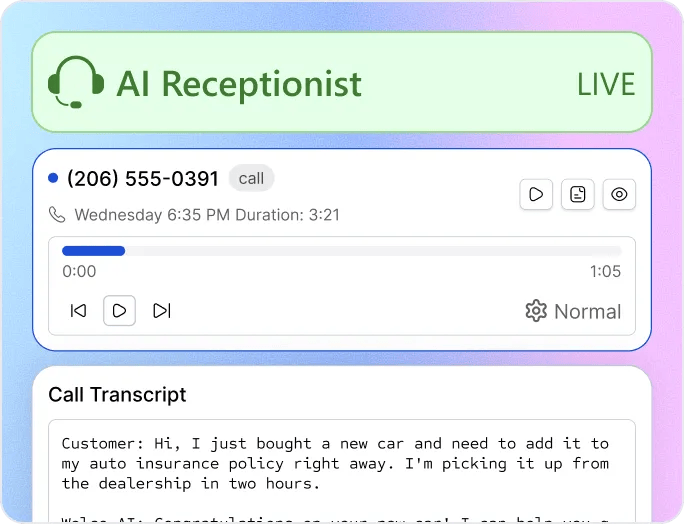

Once live, Welco answers calls instantly. Monitor transcripts, listen to recordings, and adjust FAQs anytime. Track which coverage types callers request most, identify high-value commercial policies, and optimize appointment bookings—while your agents focus on closing policies.

Listen to Our AI Insurance Agencies Answering Service in Action

Bryan Mathews

Your 24/7 Insurance Assistant Awaits – Claim Your Free Trial Today

Welco is built for independent agents, brokerages, and insurance teams who need to answer quote requests around the clock, qualify leads instantly, and serve policyholders without expanding payroll.

How Welco AI Insurance Agencies Answering Service Solves Challenges

Current Challenges of Insurance Agencies

Calls go to voicemail after 5 PM—prospects move to competitors who answer immediately and book appointments on the spot.

Client meetings constantly interrupted by ringing phones, breaking focus and reducing quality of policy consultations and customer service.

Open enrollment and storm season overwhelm staff with overflowing calls, creating long hold times and frustrated potential policyholders.

Hours wasted on “what are your hours?” and basic policy questions that pull agents away from complex underwriting work.

After-hours claims emergencies reach voicemail, frustrating clients during their most stressful moments when they need immediate support.

Lead information scattered on voicemails, sticky notes, and memory—creating follow-up gaps and lost conversion opportunities over time.

How Welco Fixes It

Capture every after-hours call with instant quote qualification and appointment booking, ensuring no evening shopper goes to competitors.

Agents stay focused on consultations while AI handles incoming calls professionally and maintaining uninterrupted client meetings

Unlimited concurrent call handling—no busy signals during peak periods like storm season or open enrollment rushes.

AI answers routine questions instantly, freeing agents for complex underwriting and sales without repetitive inquiry interruptions.

Immediate first notice of loss (FNOL) capture with on-call agent alerts containing full accident details for urgent claim situations.

Complete lead data flows directly into CRM with timestamps and transcripts, ensuring no prospect information is lost or forgotten.

Stop Losing Policies to Agencies That Simply Pick Up the Phone

Insurance agencies rely on Welco to answer quote requests, qualify leads, and handle claim inquiries—ensuring no call turns into a lost opportunity.

FAQs About AI Insurance Agencies Answering Service

Will prospects and clients think they’re talking to a real insurance agent?

Most callers won’t notice the difference. Welco’s AI receptionist sounds natural, maintains smooth conversations, and responds accurately to insurance inquiries. You can choose to have it identified as a virtual assistant if you prefer transparency. Either way, policyholders care more about getting immediate answers than whether it’s AI—and they’ll appreciate avoiding voicemail.