Welco – Your AI Accountants Answering Service

Handle Tax Season Call Surges Without Hiring Temporary Staff

March and April bring triple the normal call volume. Your receptionist can’t keep up. Welco’s overflow answering service handles unlimited calls simultaneously—no busy signals, no hold times. While your team prepares returns and meets with clients, Welco answers every call about deadlines, documents, and consultations. Tax season chaos becomes manageable without overtime, temporary hires, or stressed staff working late to return voicemails.

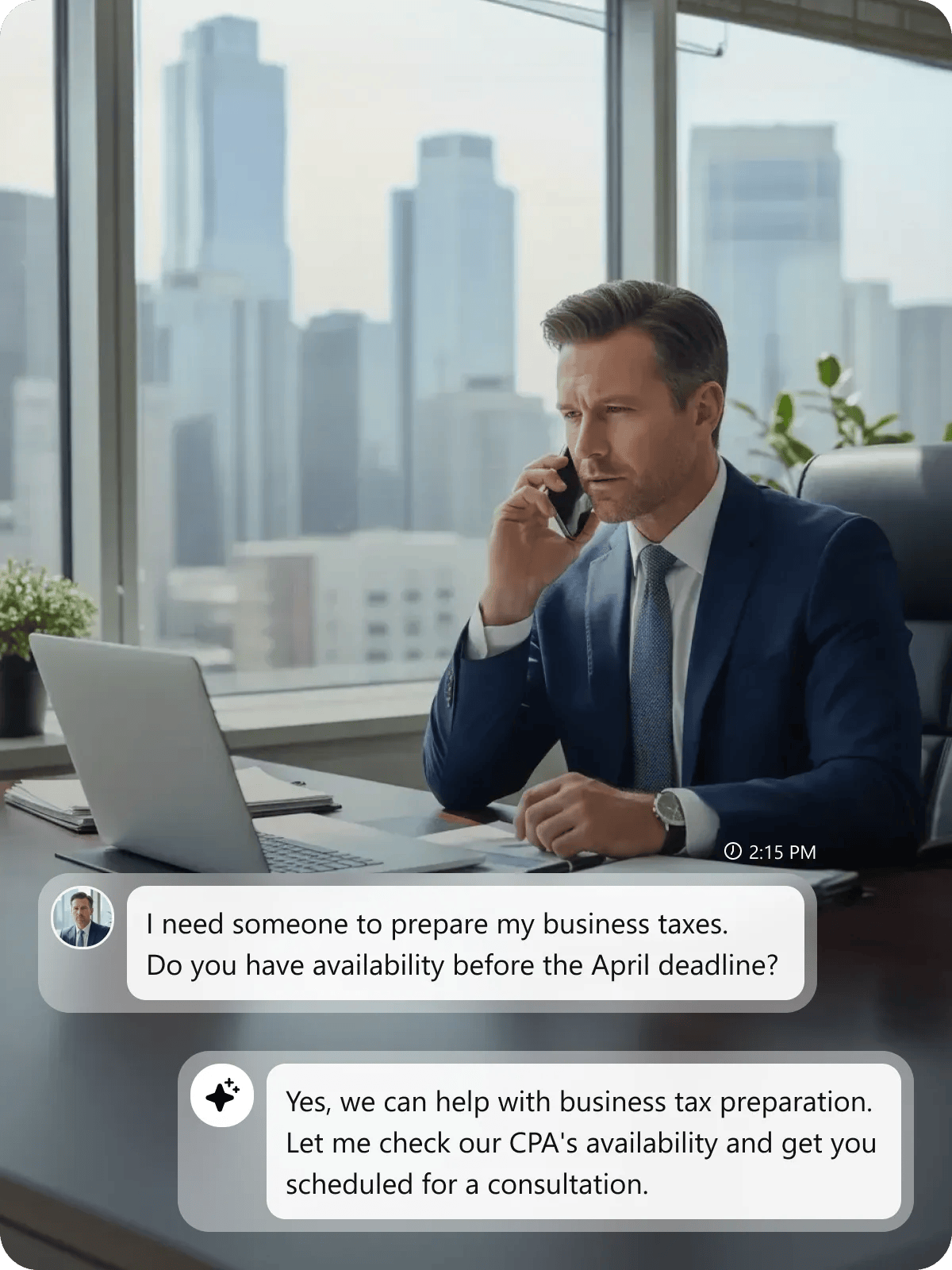

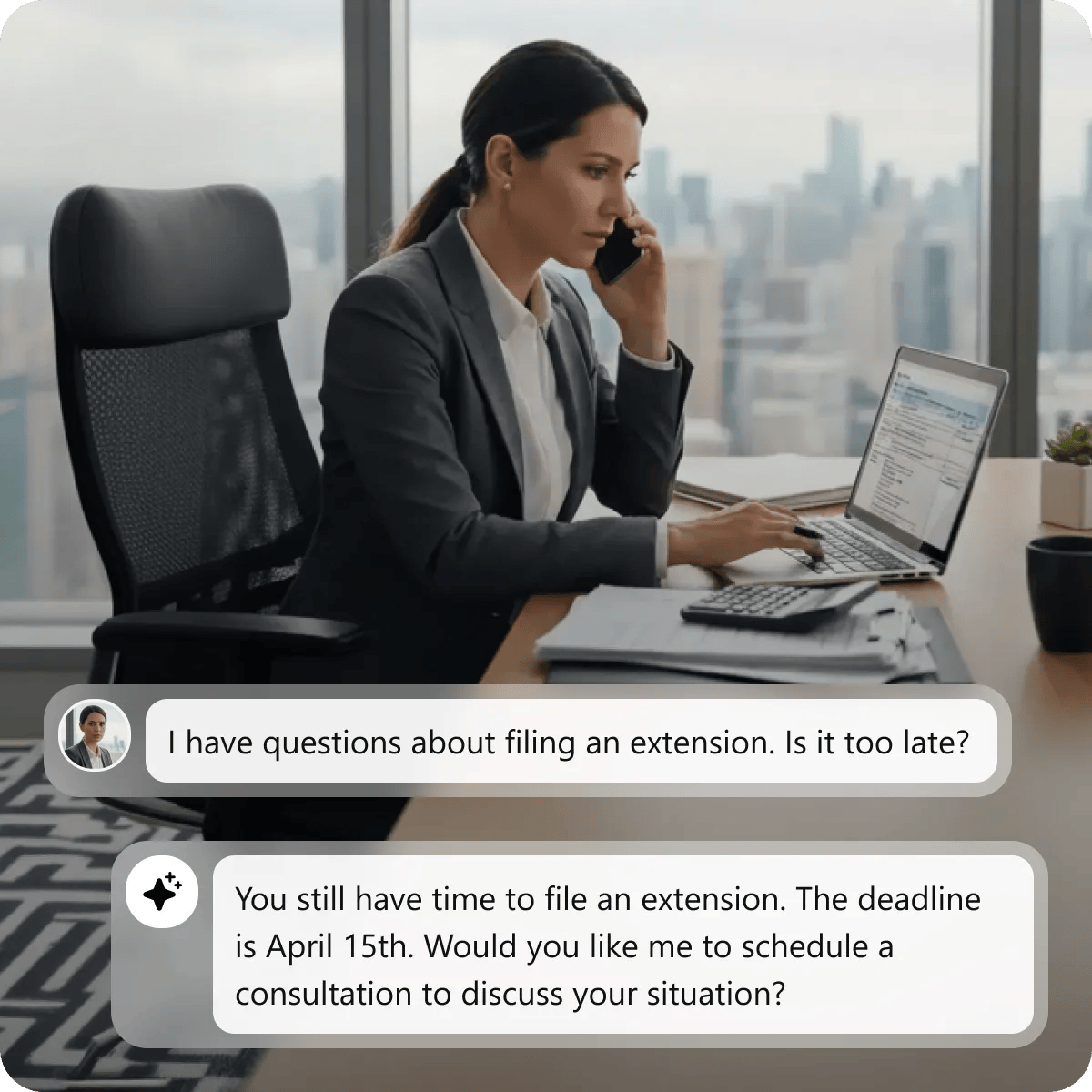

Answer Common Tax Questions Using Your Uploaded Accounting Information

Book Consultations Automatically With Calendar Integration and Confirmations

Collect Complete Client Intake Information Before Consultations

Get Your AI Accountants Answering Service Live in 15 Minutes

Quick Setup

We help you create your Welco account and assign a dedicated phone number using Twilio. Choose your AI voice and connect it to your firm—no technical setup needed. Start with a free trial to see how Welco captures and manages calls in real time. Your accounting firm starts answering every call instantly.

Upload Firm Information

Upload CPA names, specialties—individual tax prep, business returns, bookkeeping, payroll, audit support—with service details and fee schedules. Set tax season protocols for filing deadlines, document requirements, and extension procedures. Welco automatically routes inquiries by expertise.

Start Capturing Client Inquiries

Once live, Welco answers calls instantly. Monitor transcripts, listen to recordings, and adjust FAQs anytime. Track which services callers request most, identify peak inquiry times, and optimize consultation conversions—while your team focuses on tax preparation.

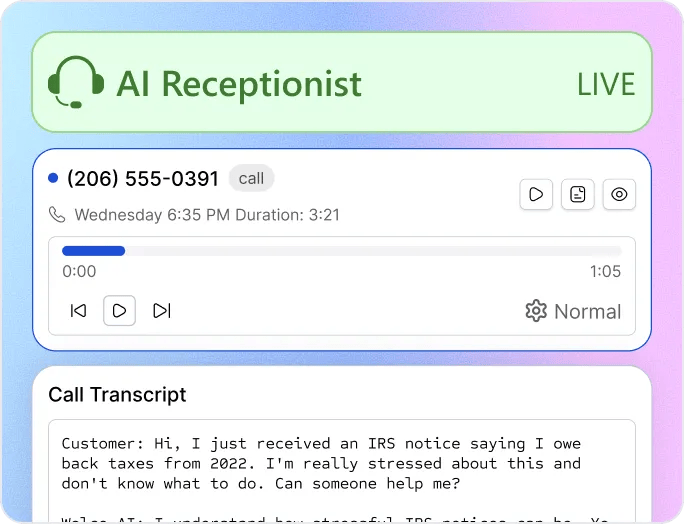

Listen to Our AI Accountants Answering Service in Action

Kevin Obrian

For CPAs Who Refuse to Lose Clients to Voicemail

Welco AI helps solo practitioners compete during busy seasons, growing firms handle call surges without hiring, and multi-location practices maintain consistent client service—capture every inquiry without expanding payroll.

How an AI Accountants Answering Service Solves Problems

Current Challenges for Accounting Firms

Receptionist explains document requirements on the phone while three more calls about deadlines and fees go unanswered during tax season.Each missed call is a prospect booking with the firm that answered first.

Tax season brings triple the normal call volume—your staff can’t keep up without working overtime or hiring temporary help.

Business owners and working professionals call evenings and weekends to find a CPA—your office is closed and they book elsewhere.Welco answers 24/7, capturing clients when competitors miss them.

Staff repeats the same answers about W-2 requirements, extension deadlines, and S-Corp filing fees 30 times daily instead of preparing returns.

Rushed calls with prospects mean missing critical details—entity type, income sources, previous CPA—requiring follow-up calls to gather complete information.

Hours spent scheduling consultations, answering basic questions, and returning voicemails reduce time for actual tax preparation work.

How Welco Fixes It

Welco handles unlimited concurrent calls simultaneously, answering document questions, deadline inquiries, and fee requests even during chaos. No busy signals, no hold times, no prospects hanging up to call competitors.

Welco scales automatically to handle seasonal surges, answering hundreds of calls during peak months without adding staff.

Welco provides 24/7 availability, capturing after-hours inquiries and booking consultations so you don’t lose prospects who search outside business hours.

Welco answers all common tax questions using your uploaded knowledge base, freeing your team to focus on billable work instead of repetitive explanations.

Welco’s intake forms systematically collect filing status, business structure, entity type, and service needs during the first call with complete accuracy.

Welco automates all non-billable administrative tasks, maximizing your team’s capacity for revenue-generating tax work and client consultations.

Stop Losing Prospects to Firms That Simply Pick Up

Accounting firms use Welco.ai to answer calls during busy periods, capture inquiries outside office hours, and schedule consultations automatically—converting voicemail into paying clients.

FAQs About AI Accountants Answering Service

What if a caller asks a tax question we’re not licensed to answer in their state?

During setup, you define your licensed states and service areas. If a caller is outside your authorized jurisdiction, Welco politely explains your licensing limitations and offers to collect their information for referral, waitlist, or future expansion. You decide whether Welco should decline or still capture the lead.