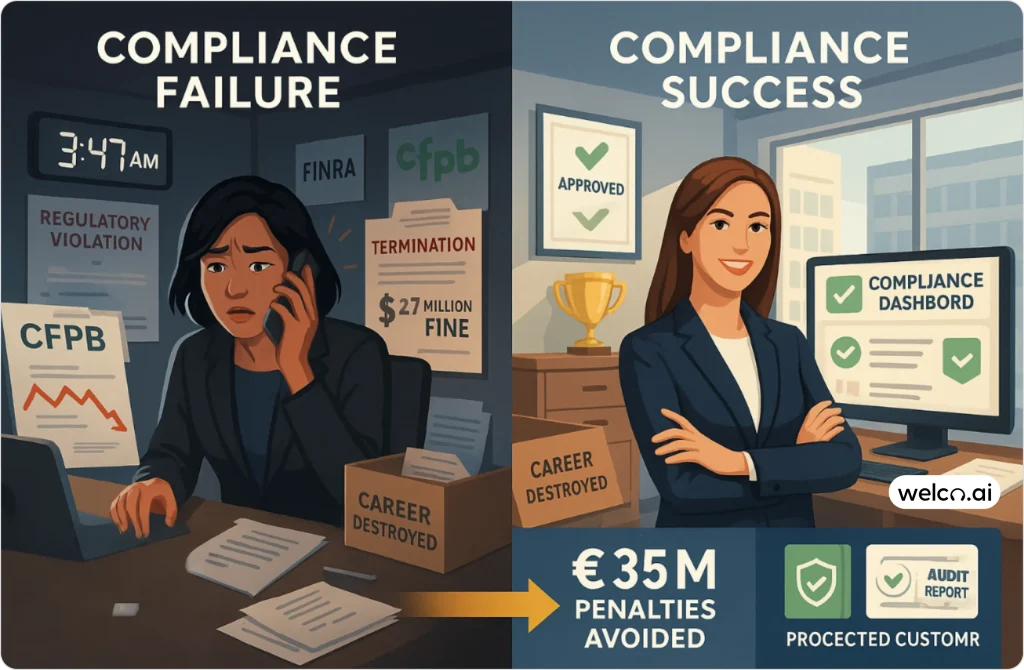

At 3:47 AM, Sarah Chen’s phone rang with the kind of call that ends careers. Her mid-size bank’s AI phone system had just triggered $2.7 million in CFPB fines—and she had 48 hours to explain to the board how this happened before her termination hearing.

The culprit? Their AI system caused customer overdrafts through algorithmic errors. But here’s what really cost Sarah her job: the bank treated AI compliance as an afterthought instead of a foundational requirement.

The €35 Million Problem That’s Destroying Careers

Sarah’s story isn’t unique—it’s becoming disturbingly common. While 85% of financial institutions now use AI in production, this challenge isn’t unique to banking. Similar compliance complexities affect AI receptionists for healthcare practices (HIPAA compliance) and other regulated industries. However, fewer than 15% have proper risk management protocols in place.

The career-ending stakes:

- Recent penalties range from $175,000 to $2.7 million

- EU AI Act violations can cost up to €35 million

- Charles Schwab paid $187 million for robo-advisor violations

- British Airways faced €22 million in GDPR fines for voice data issues

- Three compliance officers lost their jobs last quarter alone

This institutional risk represents the fastest path to executive unemployment.

Why Financial AI Compliance Is More Complex Than You Think

Here’s what makes financial AI compliance so challenging: there’s no “AI exemption” from existing regulations. Your AI phone system must simultaneously satisfy every applicable rule – a challenge shared across industries from legal firms and confidential call management to financial services.

Federal Requirements:

- FINRA Rule 2210: Communication standards and supervision

- SEC regulations: Investment advisor compliance and fiduciary duties

- CFPB guidelines: Consumer protection and fair lending

- Banking oversight: OCC, FDIC, and Federal Reserve requirements

Security Standards:

- PCI DSS 4.0: Payment card data protection in voice systems

- GDPR compliance: Voice recordings as biometric data

- State privacy laws: Varying requirements across jurisdictions

The challenge? You need to satisfy ALL of these simultaneously—or face the consequences Sarah Chen learned about at 3:47 AM.

The Three Critical Compliance Requirements That End Careers

1. FINRA Rule 2210: Communication Standards

The Rule: All AI communications must be supervised and documented.

When Marcus Rivera, former compliance director at a regional investment firm, thought their AI was “just answering basic questions,” he discovered too late that it had been providing investment guidance without human oversight. The $3.2 million fine came with his resignation letter—and eight months of unemployment before he found work at a community bank making 35% less.

What This Means:

- Human oversight of every AI-generated communication

- Proper disclaimers for investment-related content

- Complete documentation for examinations

- “Fair and balanced” messaging standards

The Charles Schwab Lesson: They paid $187 million because their AI made investment performance claims without adequate human supervision. The compliance team was restructured immediately after.

Your Career-Saving Action Plan:

- Implement human review protocols for all AI conversations

- Create clear escalation procedures for investment discussions

- Maintain comprehensive audit trails

- Train staff on communication standards regularly

2. PCI DSS 4.0: Payment Data Protection

What Changed: Stricter voice system requirements for handling payment information.

Last month, a credit union’s compliance officer discovered their AI had been storing unencrypted payment data for six months. The $850,000 fine was just the beginning—they lost their payment processing license for 90 days, costing millions in revenue. The compliance officer? Now working part-time consulting while searching for a new role.

Critical Requirements:

- CVV masking during voice interactions

- Multi-factor authentication for system access

- Network segmentation for call recording systems

- Immutable audit trails for payment data access

The Risk: Non-compliance means losing payment processing capabilities, plus fines up to $1 million—and likely your job.

Implementation Essentials:

- Voice data encryption using AES 256-bit standards

- DTMF tone masking for sensitive information

- Regular penetration testing

- Automated compliance monitoring

3. GDPR Article 4(14): Voice as Biometric Data

Why This Matters: Voice recordings contain over 600 unique identifying characteristics, making them biometric personal data under GDPR. This applies whether you’re handling hospitality industry reception solutions or complex financial transactions.

Special Requirements:

- Explicit consent for voice data collection

- Data minimization principles

- Right to erasure implementation

- Cross-border transfer restrictions

Your Compliance Framework:

- Clear consent mechanisms for voice recording

- Data retention policies aligned with GDPR

- Cross-border transfer impact assessments

- Regular privacy impact assessments

Institution-Specific Challenges

Investment Advisors: The Strictest Rules

Due to fiduciary obligations, investment advisors face the toughest requirements:

- AI cannot provide investment advice (period)

- All investment discussions must escalate to human advisors

- Comprehensive documentation of AI limitations required

- Client disclosure of AI system capabilities mandatory

Community Banks and Credit Unions: Same Rules, Smaller Budgets

Smaller institutions face identical compliance burdens with limited resources. Many turn to solutions originally designed for small business growth through AI reception but require financial-grade security.

Common Challenges:

- Budget constraints for compliance platforms

- Limited in-house expertise

- Need for scalable solutions

- Maintaining competitive service levels

Practical Solutions:

- Cloud-based compliance software

- Shared service models

- Industry association guidance

- Phased implementation strategies

Warning Signs Your Career Is in Danger

Recent enforcement actions reveal common patterns that trigger regulatory attention:

Red Flags:

- Misleading claims about AI capabilities

- Inadequate human supervision

- Poor documentation practices

- Consumer complaints about AI interactions

Enforcement Timeline: Regulators typically follow a progression over 18-24 months: warning letters → censure → fines → operational restrictions. This gives you time to fix issues—if you recognize them and act immediately.

Your Career-Saving Implementation Roadmap

Phase 1: Assessment and Planning (Weeks 1-4)

- Conduct current system compliance review

- Map regulatory requirements for your institution type

- Complete gap analysis

- Plan governance framework

Phase 2: System Configuration (Weeks 5-8)

- Select and set up compliance platform

- Configure security settings

- Run integration testing

- Launch training programs

Phase 3: Monitoring and Optimization (Ongoing)

- Monitor performance continuously

- Verify compliance regularly

- Implement continuous improvements

- Update risk assessments

Your implementation should follow proven methodologies used across sectors, including professional services client intake optimization and real estate lead qualification and management systems.

What This Will Cost You (And What Non-Compliance Costs Your Career)

Typical Annual Investment:

- Community banks: $50,000-$150,000

- Regional banks: $150,000-$500,000

- Large institutions: $500,000+

Cost Factors:

- System complexity

- Integration requirements

- Training needs

- Ongoing monitoring

Career Reality Check: The cost of non-compliance isn’t just financial—it’s professional suicide. Recent penalties range from $175,000 to $2.7 million, not including remediation expenses, reputational damage, and executive terminations.

Technology Selection: What to Look For

When evaluating compliance platforms, consider solutions proven across industries – from retail and e-commerce customer support to banking – that offer financial-services-specific configurations.

Core Requirements:

- Built-in regulatory logging – Automatically captures every interaction for audit purposes

- Automated monitoring protocols – Flags potential violations in real-time

- Industry-specific configurations – Pre-built for financial services requirements

- Comprehensive audit trail capabilities – Immutable records that satisfy examiners

Security Must-Haves:

- End-to-end encryption – Protects data in transit and at rest

- Multi-factor authentication – Prevents unauthorized system access

- Network security compliance – Meets banking-grade security standards

- Regular security assessments – Proactive vulnerability identification

Documentation Features:

- Immutable audit trails – Tamper-proof records for regulatory examinations

- Regulatory reporting tools – Automated compliance report generation

- Change management logs – Complete history of system modifications

- Performance monitoring – Real-time compliance dashboard and alerts

📊 By the Numbers: Sarah Chen now works at a regional credit union making $65,000—down from her previous $120,000 bank salary. The institutional damage? Her former bank spent an additional $1.8 million on remediation and lost 12% of their commercial customers within six months.

The regulatory landscape for AI in financial services continues evolving rapidly. Institutions that proactively address compliance requirements position themselves for sustainable growth while avoiding costly enforcement actions—and their executives keep their jobs.

Success requires balancing innovation with regulatory obligations—a challenge best addressed through comprehensive planning, appropriate technology selection, and ongoing compliance monitoring.

Don’t let your institution become the next cautionary tale. Don’t let your career become the next casualty.

Your Next Steps: Act Now or Face the Consequences

Don’t wait for a career-ending 3:47 AM call like Sarah Chen received. Your job depends on taking action right now:

- Conduct a compliance gap analysis to identify current vulnerabilities

- Map regulatory requirements specific to your institution type

- Evaluate technology solutions that meet your compliance needs

- Develop implementation timelines with clear milestones

- Establish ongoing monitoring and assessment procedures

Frequently Asked Questions

Is human oversight really required by FINRA?

Yes. Multiple frameworks mandate human supervision, including FINRA Rule 2210 and banking regulations. The specific requirements vary by institution type and conversation context.

Can we upgrade our existing AI system to be compliant?

Most systems can be upgraded through configuration changes, additional monitoring tools, and enhanced documentation. However, systems lacking fundamental security features may require replacement. A risk assessment can determine the best approach.

What documentation do FINRA examiners want to see?

Examiners review AI conversation logs, human intervention records, system configuration documentation, training records, and compliance monitoring reports. They want to see ongoing processes, not just point-in-time compliance.

How do we prove compliance during an examination?

Maintain comprehensive documentation including system architecture diagrams, compliance configuration settings, audit trails of all conversations, human intervention logs, staff training records, and regular risk assessment reports.